Simply fill in your details and we will be in touch soon to arrange a personalised demonstration.

Aligned with the AUSTRAC guidance and Starter Kits, InfoTrack’s AML/CTF Compliance Centre is your all-inclusive solution to keep your firm compliance through Tranche 2 reforms. Fully integrated into your Practice Management System (PMS), and available in an environment you’re already familiar with, the Compliance Centre is complimentary for all users – simply pay for the searches conducted.

This page breaks down these obligations and showcase how InfoTrack keeps you compliant, every step of the way.

InfoTrack provides a guided digital risk assessment workflow within the Compliance Centre, enabling all Tranche 2 entities to meet AUSTRAC expectations consistently and efficiently.

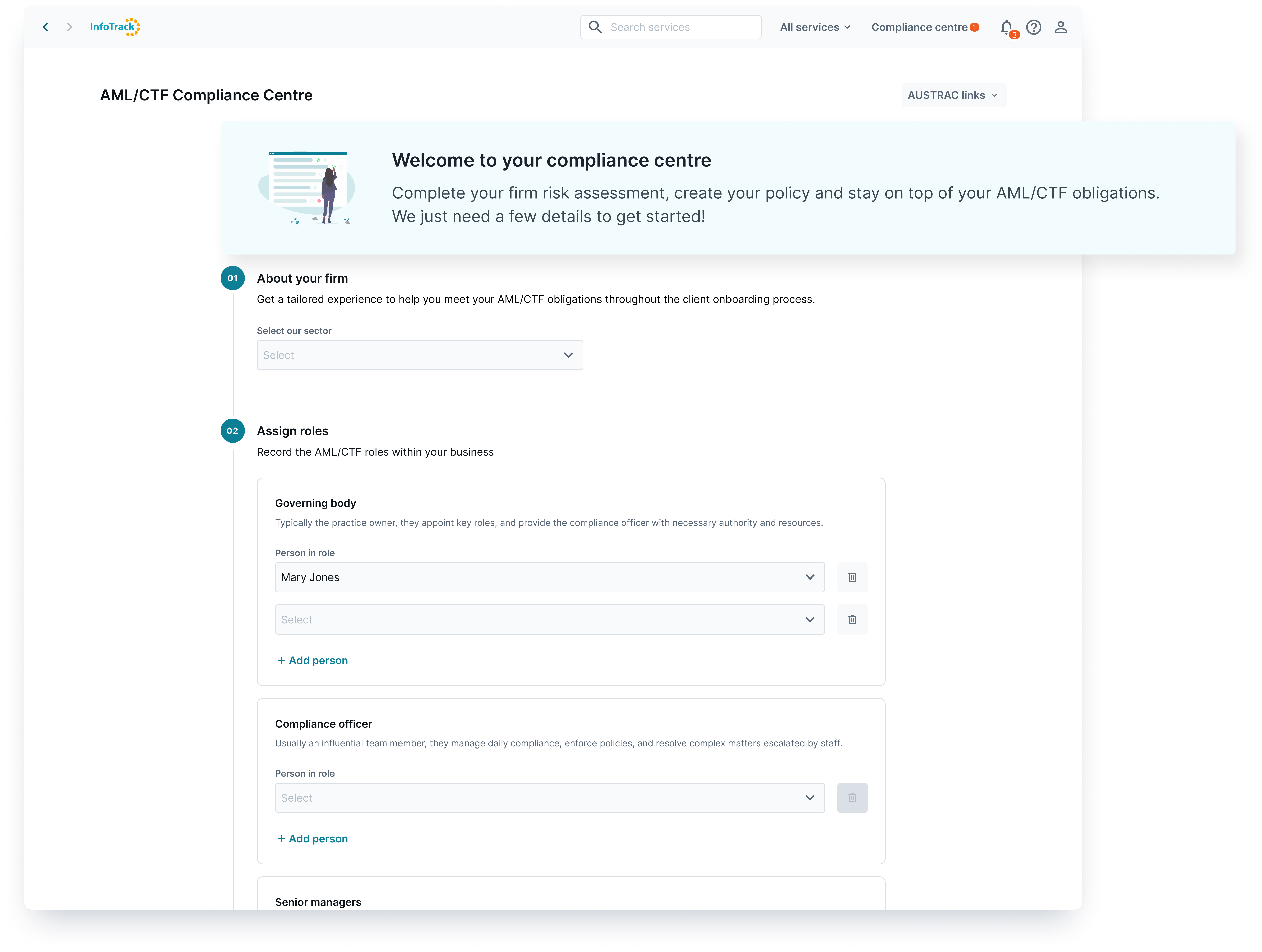

Every practice must maintain a written AML/CTF Program that sets out how they will identify, manage and mitigate ML/TF risks. The Program must include your governance structure and personnel roles, firm risk assessment, due diligence processes, staff training practices and more.

InfoTrack has complete AML/CTF training modules available in the Compliance Centre, with videos, quizzes and progress tracking.

Entities must ensure that staff involved in AML activities are suitable, verified and appropriately trained. InfoTrack has a dedicated workflow to facilitate this due diligence in a few clicks.

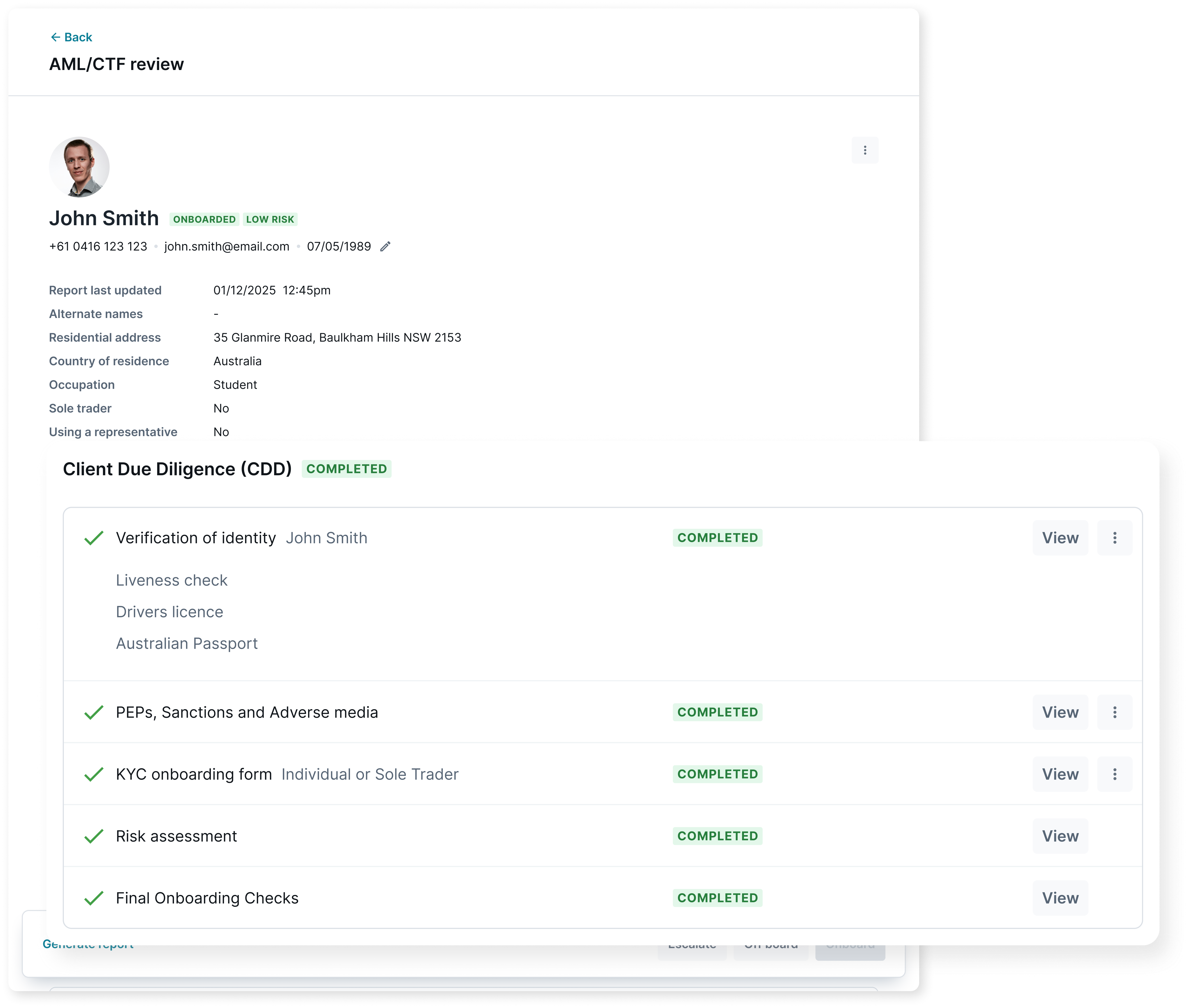

InfoTrack provides a digital Onboarding Questionnaire, pre-filled where possible, that asks all the required KYC questions. There is built-in smart logic that guides users to the right questions based on risk.

An AML verification bundle is available through your ecosystem including VOI, PEPs, Sanctions, Adverse Media and even the Onboarding Questionnaire. There are further options for Enhanced Due Diligence checks such as Verification of Funds, if required.

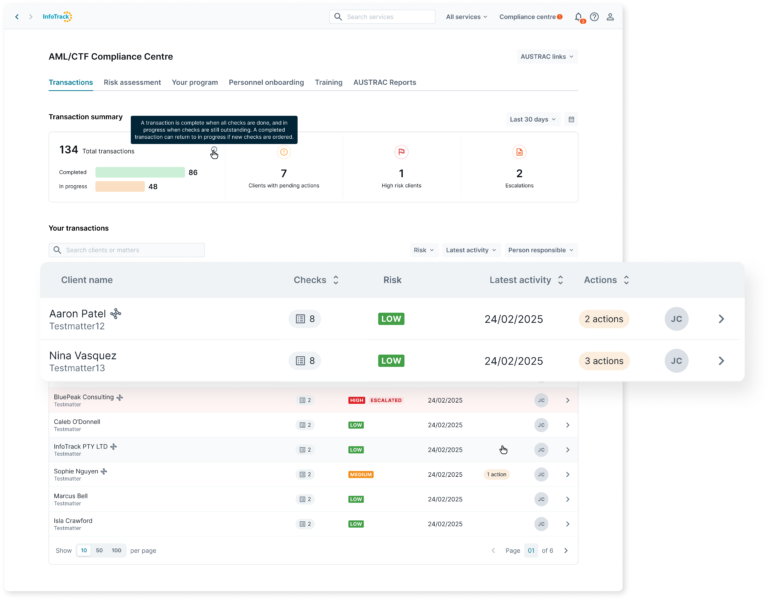

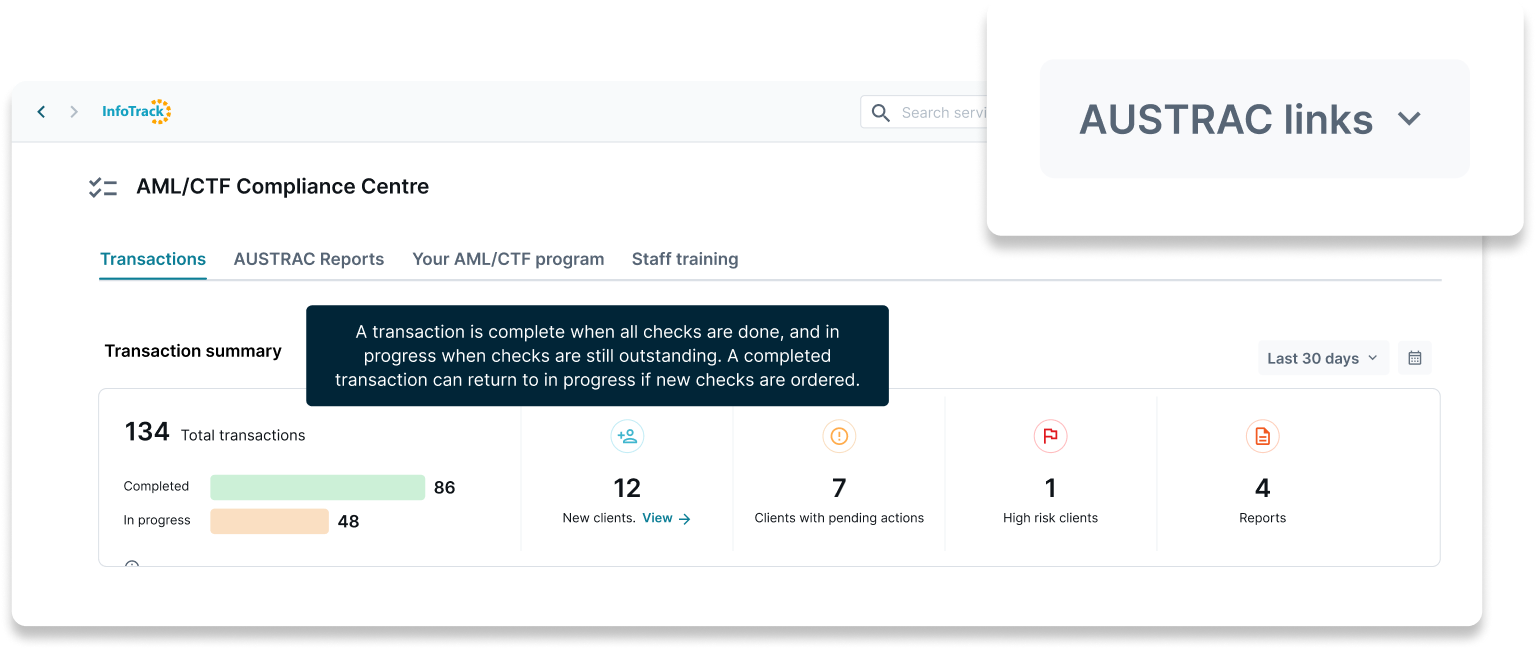

The InfoTrack system will automatically generate a Customer Risk Report based on onboarding questionnaire responses and due diligence search results. A clear risk rating will be applied, with prompts to escalate if required.

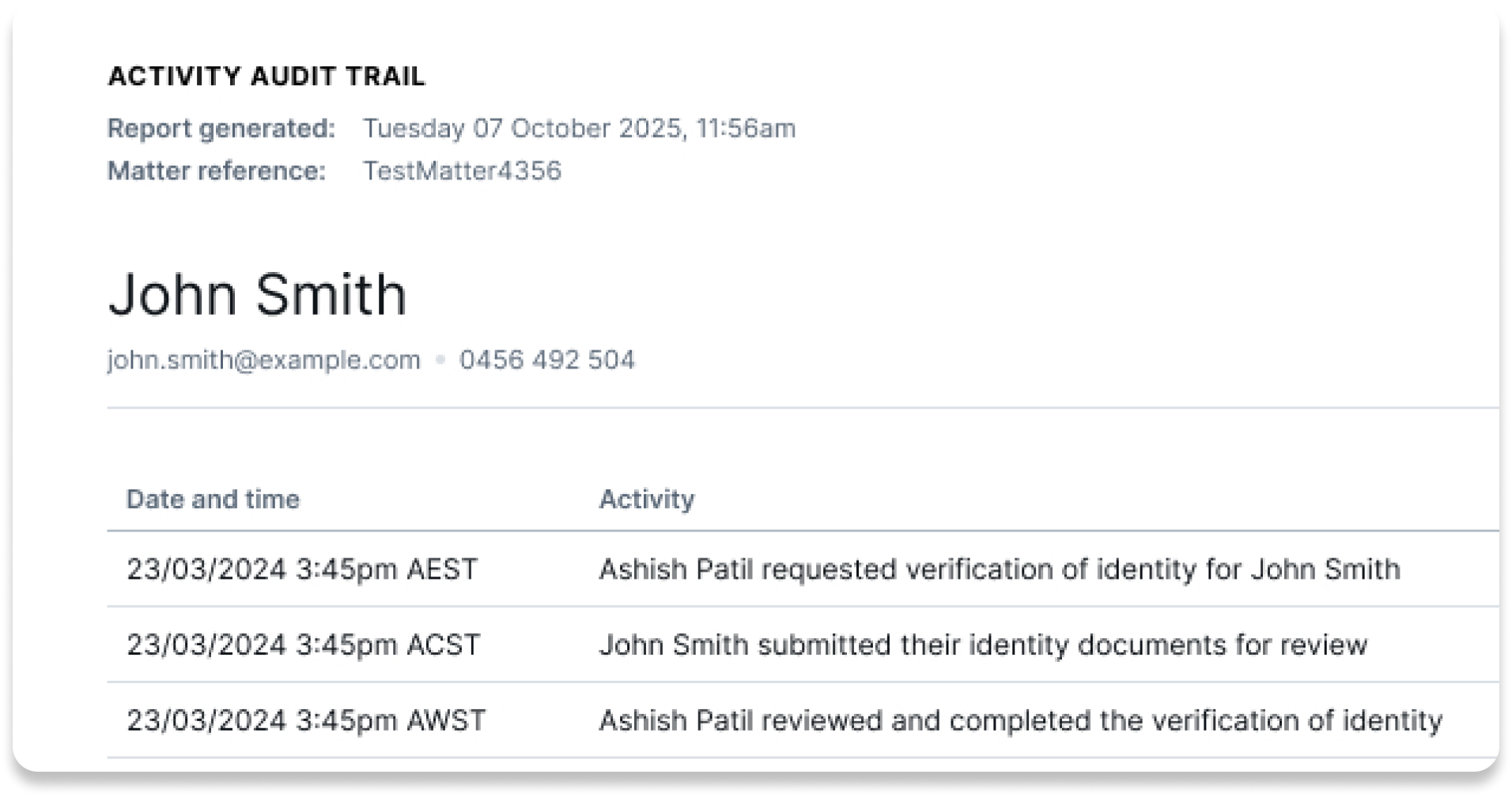

A consolidated AML report is automatically generated for review. This contains all the customer information and risk rating, suitable for storage and ready for Audit. This report can also be shared with 3rd parties

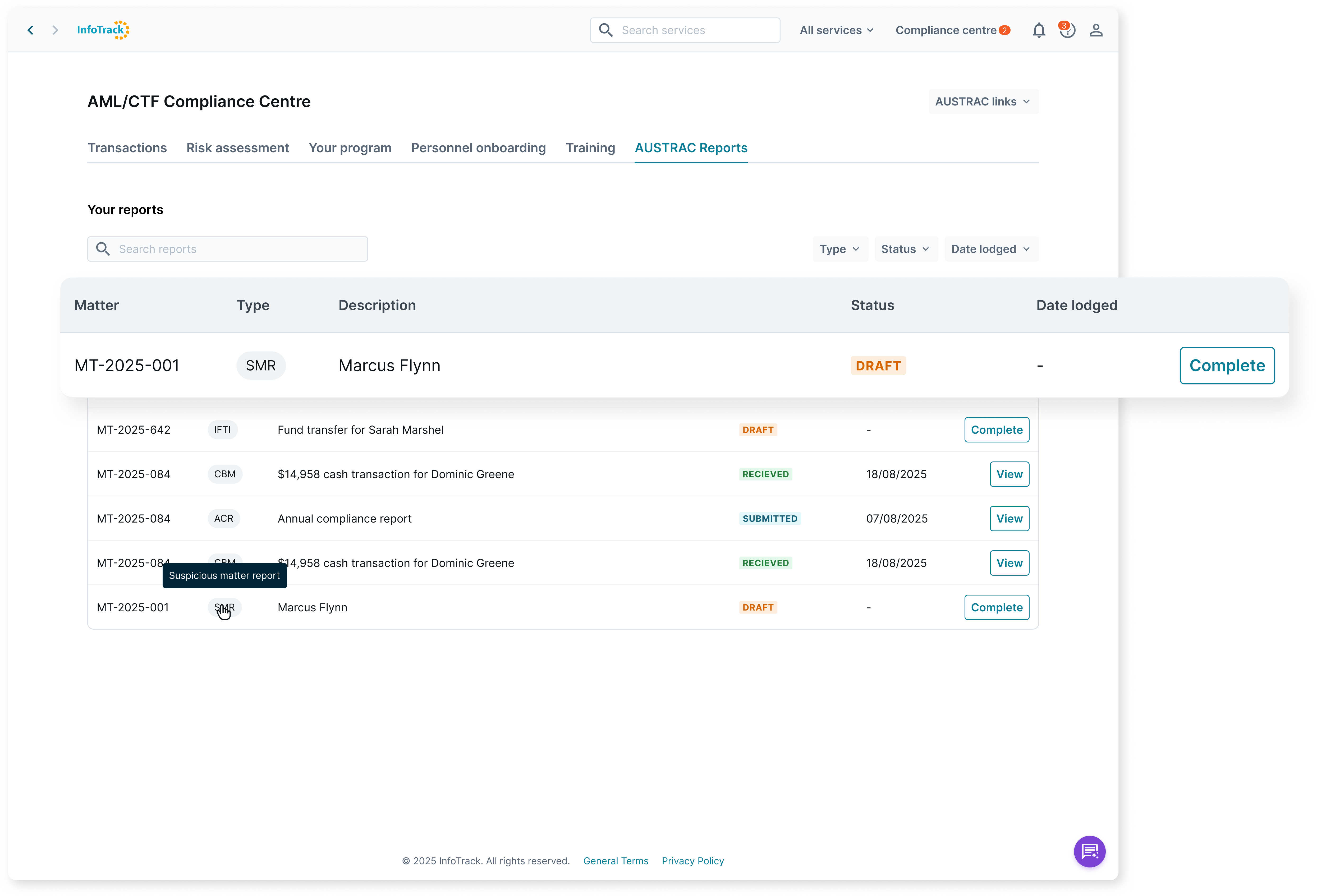

Tranche 2 entities are obligated to report certain clients to AUSTRAC based on their risk and behaviours. InfoTrack gives users the ability generate Suspicious Matter Reports, Transaction Threshold Reports and more, directly from the matter. Information is prefilled where possible and sent directly to AUSTRAC, as well as being stored inside the Compliance Centre for audit purposes.

Every reporting entity must submit an Annual Compliance Report (ACR) to AUSTRAC by 31 March each year. InfoTrack simplifies annual compliance reporting by providing a Compliance Dashboard inside the Compliance Centre. In a few clicks, the Annual Compliance Report can be generated and sent to AUSTRAC for review.

Extended training

Content TBC

Simply fill in your details and we will be in touch soon to arrange a personalised demonstration.

Tranche 2 is the next phase of AML/CTF regulatory obligations in Australia, coming into effect in 2026. It expands compliance requirements to cover additional professionals and activities that were not fully included under Tranche 1. This includes certain property transactions, complex onboarding of clients, and reporting obligations when handling client money. Professionals captured under Tranche 2 include lawyers, conveyancers, accountants, and real estate agents involved in these activities. Organisations must ensure they meet these requirements to remain compliant with AUSTRAC regulations.

Tranche 2 obligations are expected to take effect in 2026. Organisations should start preparing now to ensure compliance.

AML/CTF stands for Anti-Money Laundering and Counter-Terrorism Financing. It is designed to prevent illegal funds and terrorism financing from entering the financial system.

AUSTRAC are expected to release the starter packs in January 2026.

Non-compliance with Tranche 2 can lead to civil and criminal penalties under AUSTRAC regulations, including fines and reputational risk. However, AUSTRAC has indicated that during the first year of Tranche 2, they do not anticipate issuing substantial fines.

This will vary depending on the services provided. Generally, any activity involving handling client money or property transactions may now fall under AML obligations.