Banks are tightening lending standards, and credit growth is slowing. These raise the risks of the current downturn to continue into 2019 with price falls of 5% or more, which may lead to the most prolonged recession in decades. Having a stringent financial system and law enforcement could be advantageous for some because deceptive applications and easy loans are unlikely. However, this, as a result, makes buying property in Australia less attractive for foreign investors.

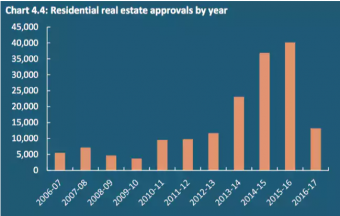

The decrease in international approvals to purchase Australian residential property is another factor that makes the Australian housing market unattractive. Approvals for foreign investors to buy Australian property dropped from 40,000 to 13,000 in 2016-2017, which discourages foreign investors from applying for approvals. Foreign Investment Review Board’s (FIRB) decision to decrease international approvals removes a hefty amount of potential cash from the market.

Business reporter, Michael Janda of ABC News, thinks that a global inflation revival and an increase in overseas rates may force the hand of RBA into increasing the national interest rates or at the very least, force retail banks into rising mortgage rates.

Households will be taking on more debt due to a likely rise in interest rates, which could begin late this year or early 2019. Australians will be unable to pay for mortgages, which results in an economic-wide issue.

Due to an increase in debts and mortgages, consumer behaviour is set to be more conservative in purchasing goods and services, drastically affecting local businesses.