Your dedicated Client Relationship Manager will be available to demonstrate how InfoTrack can help equip you with the right tools.

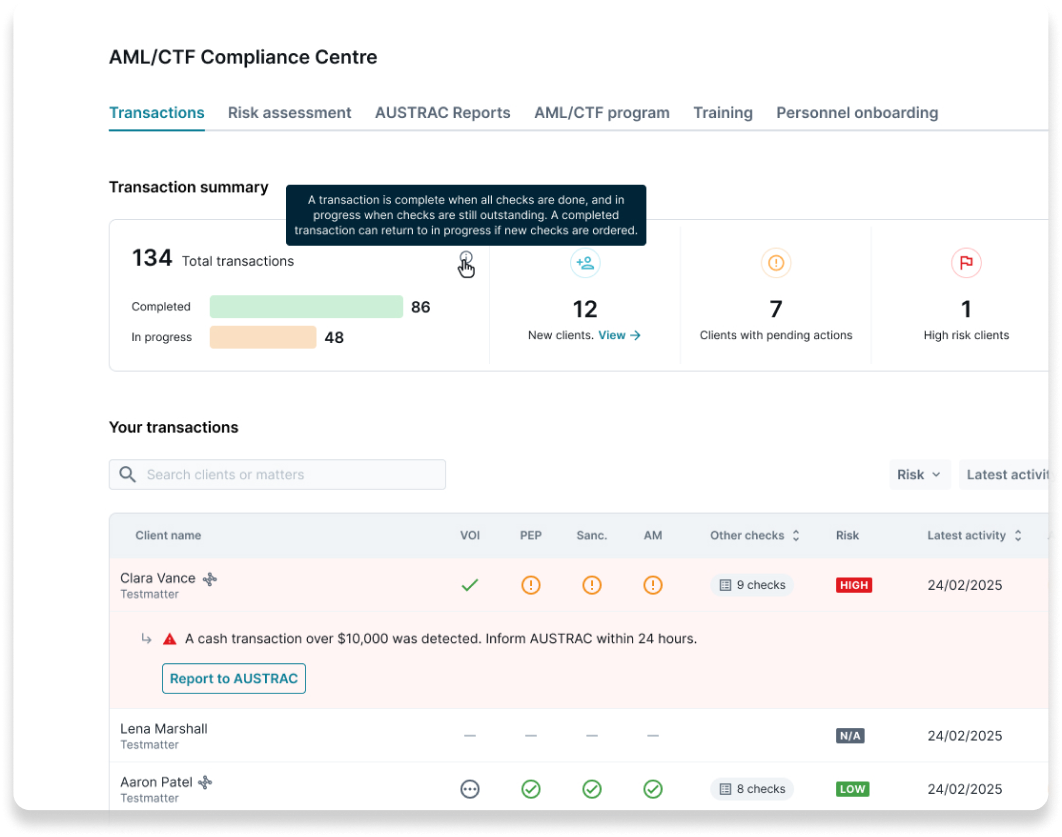

From 31 March 2026, professionals can access the Compliance Centre to begin their enrolment journey. Inside the Compliance Centre, firms will find:

This ensures firms are correctly registered and that all evidence is centrally retained for audits or regulatory reviews.

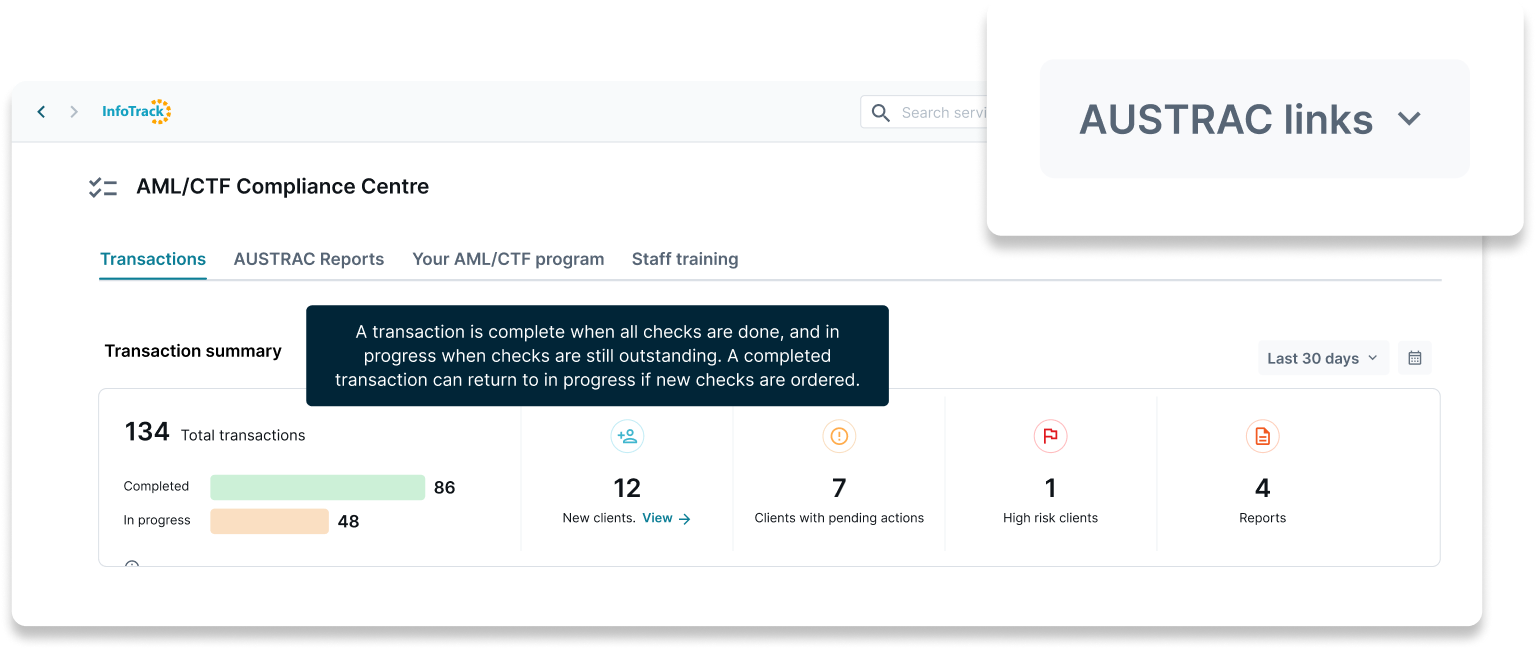

Firm level risk assessment

InfoTrack provides a guided digital risk assessment workflow within the Compliance Centre, enabling all Tranche 2 entities to meet AUSTRAC expectations consistently and efficiently.

Develop your AML/CTF program and policies

Every practice must maintain a written AML/CTF Program that sets out how they will identify, manage and mitigate ML/TF risks. The Program must include your governance structure and personnel roles, firm risk assessment, due diligence processes, staff training practices and more.

Train staff

InfoTrack has complete AML/CTF training modules available in the Compliance Centre, with videos, quizzes and progress tracking.

Conduct Personnel Due Diligence

Entities must ensure that staff involved in AML activities are suitable, verified and appropriately trained. InfoTrack has a dedicated workflow to facilitate this due diligence in a few clicks.

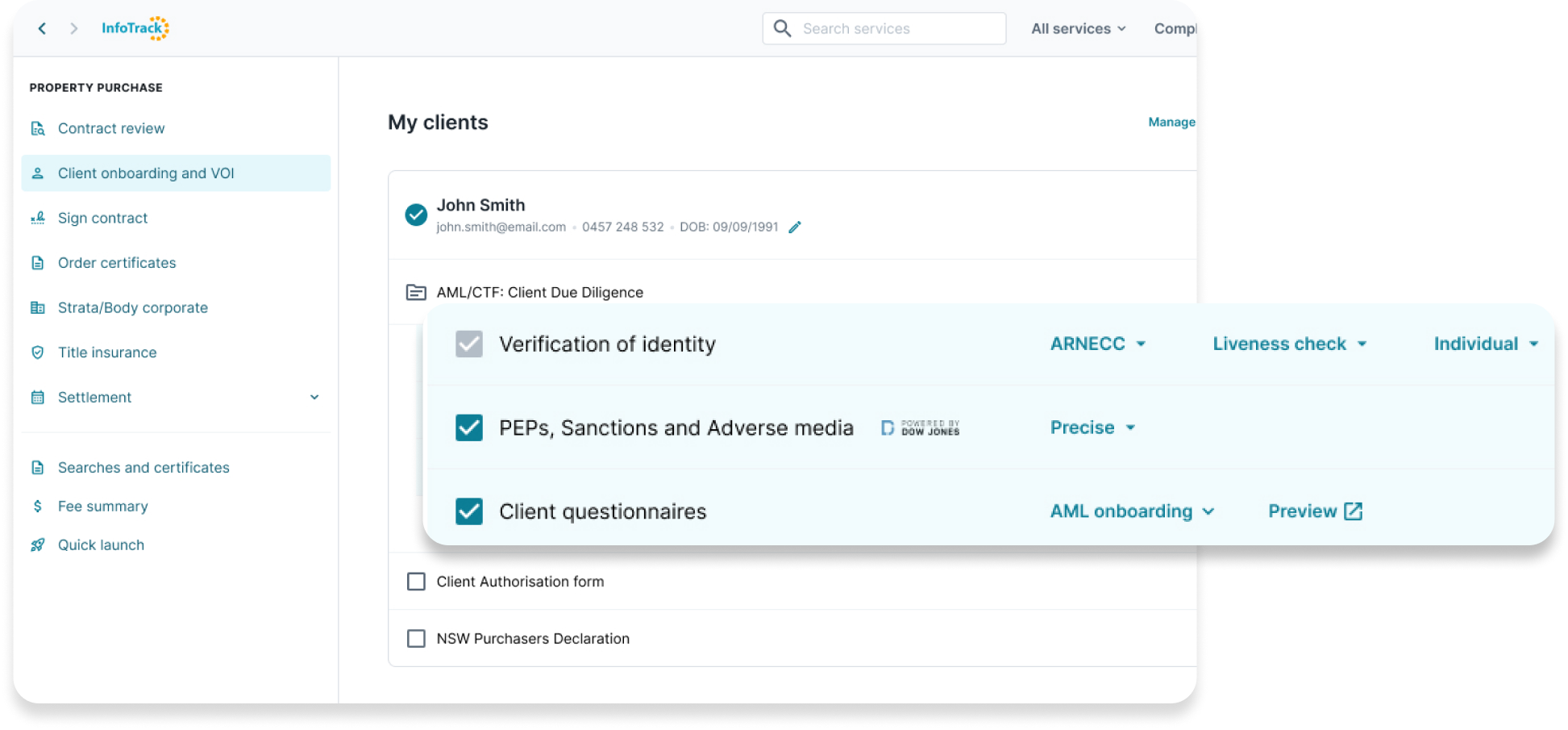

Onboarding Questionnaire

InfoTrack provides a digital Onboarding Questionnaire, pre-filled where possible, that asks all the required KYC questions. There is built-in smart logic that guides users to the right questions based on risk.

Customer Due Diligence and Enhanced Due Diligence

An AML verification bundle is available through your ecosystem including VOI, PEPs, Sanctions, Adverse Media and even the Onboarding Questionnaire. There are further options for Enhanced Due Diligence checks such as Verification of Funds, if required.

Customer Risk Assessment

The InfoTrack system will automatically generate a Customer Risk Report based on onboarding questionnaire responses and due diligence search results. A clear risk rating will be applied, with prompts to escalate if required.

AML report generated

A consolidated AML report is automatically generated for review. This contains all the customer information and risk rating, suitable for storage and ready for Audit. This report can also be shared with 3rd parties

Transactional reports

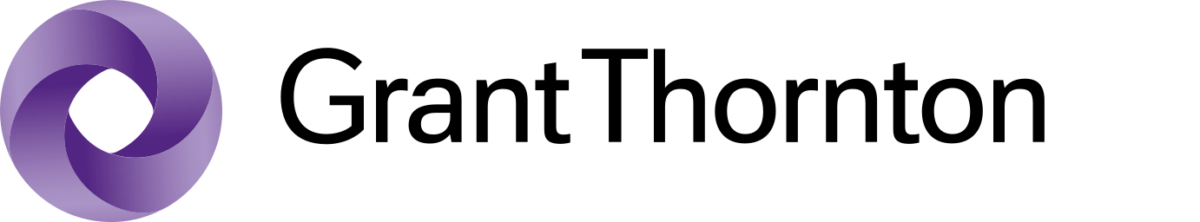

Tranche 2 entities are obligated to report certain clients to AUSTRAC based on their risk and behaviours. InfoTrack gives users the ability generate Suspicious Matter Reports, Transaction Threshold Reports and more, directly from the matter. Information is prefilled where possible and sent directly to AUSTRAC, as well as being stored inside the Compliance Centre for audit purposes.

Annual Compliance Reports

Every reporting entity must submit an Annual Compliance Report (ACR) to AUSTRAC by 31 March each year. InfoTrack simplifies annual compliance reporting by providing a Compliance Dashboard inside the Compliance Centre. In a few clicks, the Annual Compliance Report can be generated and sent to AUSTRAC for review.

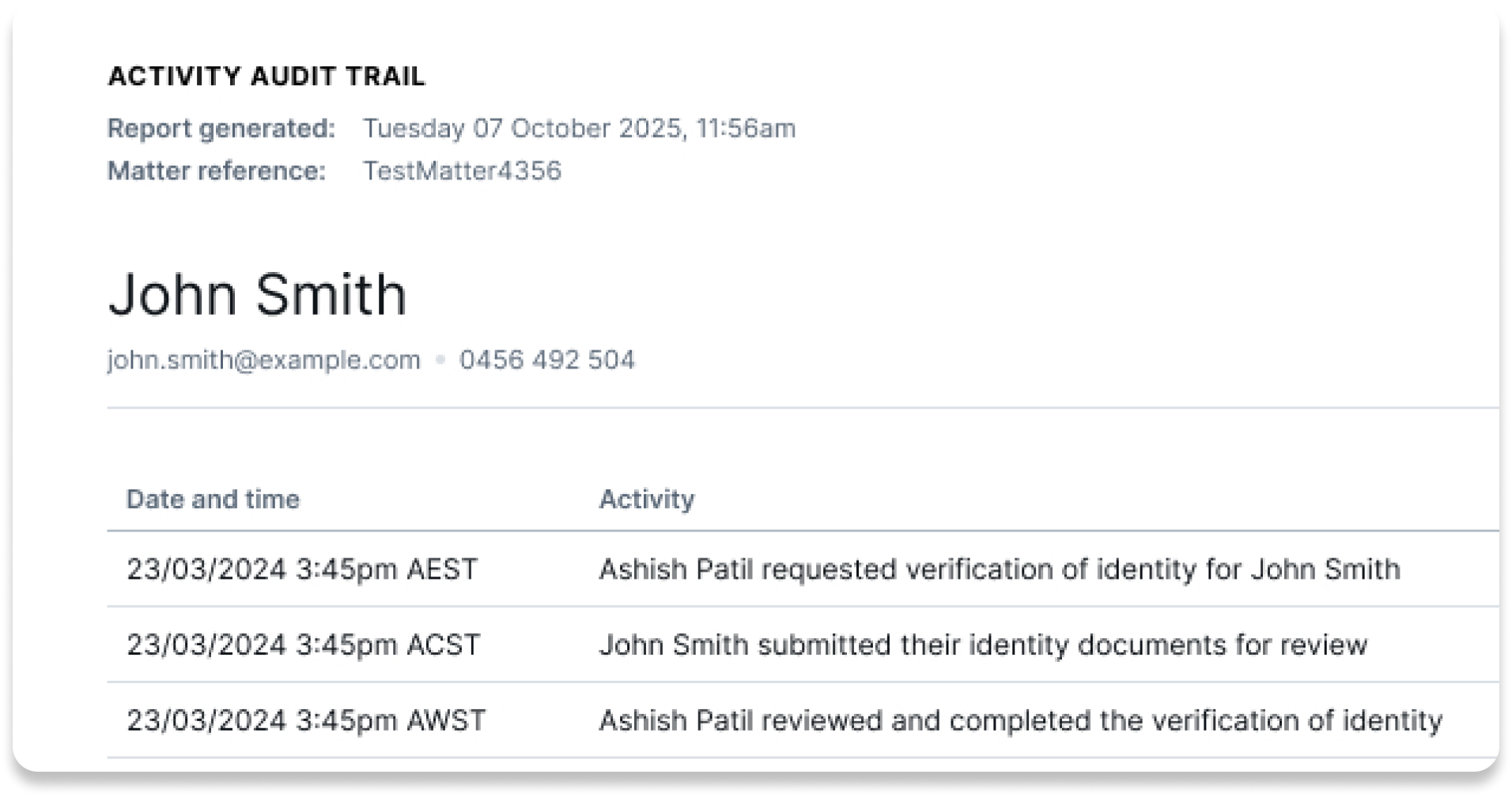

Record keeping is the backbone of AML/CTF compliance. AUSTRAC requires Tranche 2 entities to maintain clear, complete and auditable records of every step taken, from onboarding customers to reporting suspicious activity.

InfoTrack delivers automated, end-to-end record keeping inside the Compliance Centre, ensuring Tranche 2 entities always meet AUSTRAC’s retention requirements. All data is tracked via an activity log and stored for 7 years inside the Compliance Centre.

Extended training

Content TBC

Tranche 2 is the next phase of AML/CTF regulatory obligations in Australia, coming into effect in 2026. It expands compliance requirements to cover additional professionals and activities that were not fully included under Tranche 1. This includes certain property transactions, complex onboarding of clients, and reporting obligations when handling client money. Professionals captured under Tranche 2 include lawyers, conveyancers, accountants, and real estate agents involved in these activities. Organisations must ensure they meet these requirements to remain compliant with AUSTRAC regulations.

Tranche 2 obligations are expected to take effect in 2026. Organisations should start preparing now to ensure compliance.

AML/CTF stands for Anti-Money Laundering and Counter-Terrorism Financing. It is designed to prevent illegal funds and terrorism financing from entering the financial system.

AUSTRAC are expected to release the starter packs in January 2026.

Non-compliance with Tranche 2 can lead to civil and criminal penalties under AUSTRAC regulations, including fines and reputational risk. However, AUSTRAC has indicated that during the first year of Tranche 2, they do not anticipate issuing substantial fines.

This will vary depending on the services provided. Generally, any activity involving handling client money or property transactions may now fall under AML obligations.